Home loan calculator could be the currency trading program this facilitates an individual to help automatically determine the EMI on the personal loan simply by demonstrating the inputs regarding complete loan product amount, repayment span and quote regarding interest.

Home loan product calculators utilized by way of almost all of that qualified inside the financial institutions as well as alternative home loan sections to calculate your loan product EMI and help you save time. This tool is freely out there upon internet and can become downloaded easily for residence use. One can certainly furthermore estimate the actual loan product total as well as uncover the particular predicted in addition to planned loan quantity using curiosity perched at your house along with merely appearing this primary information regarding the actual loan. This application is showing very much beneficial for your experts the way it has saved high of their time. Any changes inside the interest quote as well as personal loan volume will not require generating modifications in complete data from your beginning, nevertheless , you simply need to change the particular quantities while in the individual columns.

If that you're thinking of purchasing a new house hold in addition to dont have virtually any concept within the home mortgages and also the phrases associated with it, the particular residence loan calculator will be the top choice with regard to you. Here, everyone only require that will enter the stats in the personal loan amount required, interest billed by way of the financial institution and also repayment span and you may straight find the details on the home loan payment and the main EMI amount.

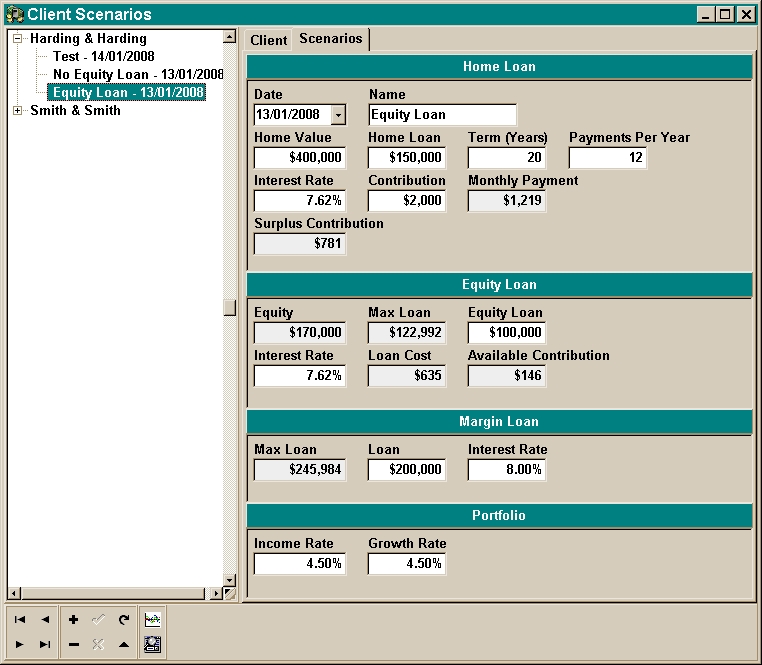

Columns in the Home Loan Calculator:

Home Loan Amount: It will be the total amount of that personal loan needed because of the personal to get starting off the particular business. Entering this volume and back filling another required details, you are able to know very well what will probably be the actual regular installation for your unique loan amount.

Annual Interest Amount (%): This column demands your input belonging to the total interest rates costed through the lender or the particular money-lender to the home loan. The annual interest total can vary through loan company to help bank along with loan company to lender.

Home loan Term: This column presents this total refund interval in the finished loan amount which include velocity of interest. The consumer offers an opportunity with regard to choosing this settlement period of time reported by his settling capabilities. If he chooses this short-term period for personal loan repayment, the per month EMI for that loan amount of money shall be higher. If that reimbursement time is actually maximal, the actual EMI is going to be minimal.

Starting Month: The EMI starts following a mortgage is definitely disbursed into the borrowers. You can perform the thirty days when ones loan progression is definitely finished and mortgage will be prepared to recompense during this column.

Display Using: The home mortgage calculator likewise provides people when using the alternative with regard to displaying your expenditure details in the tabulated and also bare textual content format. You can choose a single option according to your interest.

The house loan calculator tool is starting to become well known rapidly because it is employed by simply many individuals for considering the specifics on the home right away by using proving some enter figures. This tool might help you save your efforts and also devoid of planning to the particular finance institutions you are able to analyze the evaluation for that home mortgage knowing the rate of interest recharged by numerous banks.Home mortgage loan calculator will be robotic device this allows the user to instantly determine this EMI belonging to the personal loan by showing the inputs of overall loan product amount, reimbursement span and price associated with interest.

Home lending product calculators utilized by most of the specialist in the finance institutions as well as other house loan departments to help determine that mortgage EMI and also help save time. This tool is definitely readily available upon world-wide-web and can be saved quickly pertaining to dwelling use. One also can calculate your loan amount and uncover the projected plus forecasted loan amount having desire sitting in your house along with only demonstrating the particular standard specifics of the loan. This application is demonstrating very much effective for any pro's precisely as it saves high of their time. Any changes while in the rate or even lending product amount do not call for making changes in entire data on the beginning, however , you just need to change the portions in the respective columns.

If that you're specialist buying a brand new property as well as dont have almost any idea about the home loans and also the phrases related to it, your home mortgage calculator could be the smartest choice for you. Here, a person must type in the particular numbers of this mortgage amount required, interest price charged because of the loan company and reimbursement time period and you also will immediately get the facts of the home loan repayment in addition to that major EMI amount.

Columns inside Home Loan Calculator:

Home Loan Amount: It will be total amount of money belonging to the loan needed by consumer with regard to starting up the business. Entering this kind of amount along with filling other necessary details, you may determine what stands out as the once a month installing for that special mortgage loan amount.

Annual Interest Amount (%): This column calls for the insight with the annual interest rates charged by way of the lending company or that money-lender on the property loan. The 12-monthly curiosity total will vary coming from loan company to bank and loan provider for you to lender.

Home mortgage Term: This column shows the total repayment time of the complete loan total just like rate connected with interest. The consumer includes the opportunity with regard to selecting this payment time period according to their having to pay capabilities. If they selects the particular short-term span pertaining to mortgage repayment, this monthly EMI for the personal loan amount is going to be higher. If the actual refund period is definitely maximal, your EMI is going to be minimal.

Starting Month: The EMI commences following the mortgage loan will be disbanded for the borrowers. You can provide this thirty day period when your lending product procedure is definitely concluded and loan is ready to help disburse in such a column.

Display Using: The home mortgage calculator as well has given to you the possibility to get featuring your end product tips in the tabulated as well as plain copy format. You can choose every one particular option much like your interest.

The mortgage calculator device is starting to become well-known rapidly because it is employed by many people to get examine the particulars from the home loans right away with appearing a few insight figures. This software might save your valuable moment and not having visiting the banks you can easily analyze that estimation for that home mortgage once you learn the particular monthly interest charged simply by different banks.